Q-Card launches innovative app

The new Dutch fintech label, located in Rotterdam, Q-Card allows companies to provide their employees with virtual payment cards through a uniform payment solution.

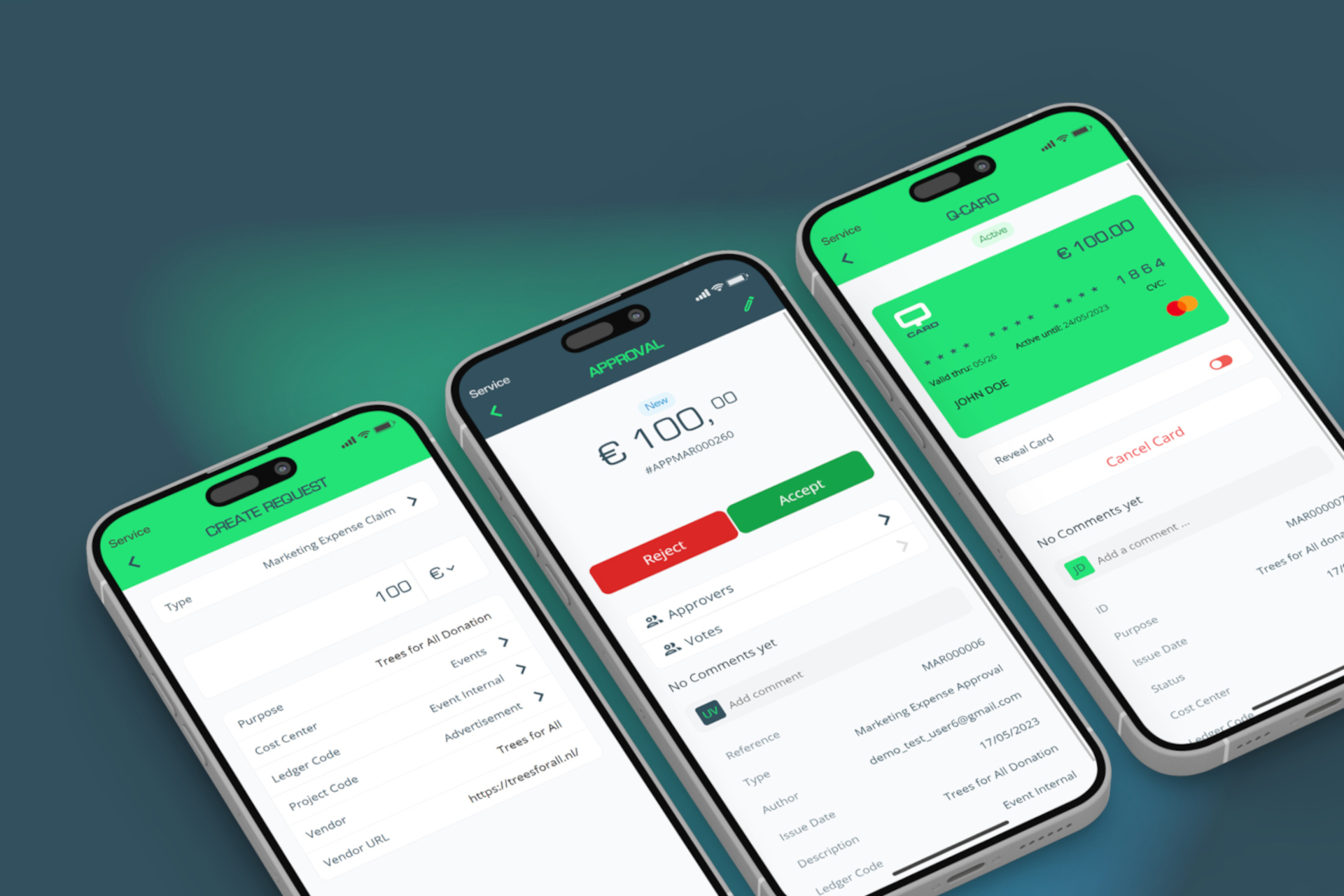

Q-Card launches innovative app that helps companies better control and manage online spending

The intuitive application process via the Q-Card app gives companies the flexibility to set custom budgets and approval rules per user type for the purchase of products and services. A one-time limited card is issued for each purchase. These virtual Q-Cards are full Mastercards, comparable to a physical credit card that also includes a card number, validity date, CVC and verification code. The app will ensure secure and transparent cash flows by directly linking online purchases to transactions, capturing purchasing data with detailed reports, and seamless integration with any accounting system.

Q-Card is an initiative of Quyntess, an expert in Supply Chain Management apps that improves collaboration between supply chain partners on a global scale. By launching Q-Card, the company is targeting a new product-market combination in which companies can bring so-called 'long tail spend' under control, with the current focus on 'online' spend as a fast-growing category. The advantage is that no master data has to be entered into the ERP or accounting system for this broad and slow group of one-time suppliers, with detailed requirements in the field of 'Know Your Customer' (KYC). “We are extremely proud that we have developed this product entirely according to the Agile principles for one of our launching customers,” says Rob van Ipenburg, CEO at Q-Card. “The trend of online B2B spend will increase in the Netherlands, as elsewhere in the world, and that requires an efficient payment solution such as Q-Card. In the Netherlands, this segment will reach a growth of 70% in 2025. For many companies, this is now 10% or more of the spend volume, which is why this solution fits in perfectly with the digital transformation strategy for procure-to-pay processes.”

In order to carefully facilitate card issuing, Quyntess has opted for a strategic partnership with Adyen, which is active worldwide with its financial technology. “Adyen facilitates the entire transaction flow – that means both card issuance and acquiring,” said Thom Ruiter, VP Banking and Financial Products at Adyen. “We are extremely happy to enter into this partnership with Quyntess. In addition to the many users in e-commerce, together with Quyntess, we are expanding our Issuing portfolio in various branches, such as the manufacturing industry and logistics sectors.”

Additional information

Jan Verbreuken

Chief Revenue Officer

+31 (0)85 750 0493

Share this

Curious how it works

Q-Card Virtual Cards offer a smarter way to manage your company's long-tail spend. Give your employees the power to explore the world of corporate virtual payment cards.

About Quyntess

Quyntess is committed to better, faster and real-time collaboration between supply chain partners at all levels of operational excellence and maturity. The cloud-based service brings together the power of B2B networking and web platform technologies into a comprehensive solution that improves digital collaboration in the supply chain and achieves an integrated procure-to-pay landscape. The company's customer base includes Lely, Vanderlande, VMI Group, GKN, Marel and Canon.

About Adyen

Adyen is the preferred financial technology platform of leading companies. With end-to-end payment options, data-based insights and financial products in one solution, we help companies worldwide achieve their ambitions faster. Adyen has locations all over the world and works with companies such as Facebook, Uber, H&M, eBay, Rituals, de Bijenkorf and the Rijksmuseum.

Ready to get started?

Get more insights today

Our scans help corporations identify the right improvement potential with Q-Card. They provide an objective assessment of current performance and insights into financial benefits that can be monetised by managing tail spending.